How To Get Excise Duty Stamps Now for Cannabis, Vaping and Tobacco

If you are thinking of importing or manufacturing cannabis, tobacco or vaping products, chances are you will need to apply for the excise stamping regime and apply excise stamps to your products before they enter the duty-paid market in Canada. As of October 2022, the Canadian government has started to enforce the vaping excise stamping regime, which is in addition to the cannabis and tobacco products excise duty regime which is already in effect and being enforced. It is important to ensure compliance with all relevant regulations, including the unlicensed natural health product regulations that may apply to certain formulations. Failure to adhere to these requirements could result in significant penalties or restrictions on the sale of your products. Staying informed about shifting regulations will help safeguard your business and maintain access to the Canadian market. Failure to comply with these regulations can result in significant penalties and disruption to your business operations. To ensure that you are fully informed about your responsibilities, it is essential to familiarize yourself with tobacco and vaping regulations explained in detail by the Canadian government. Engaging with industry experts and legal advisors can also provide valuable insights to navigate this complex regulatory landscape.

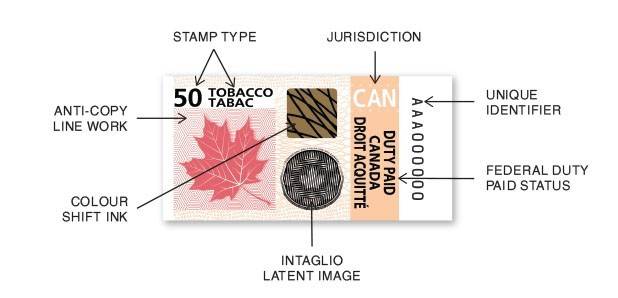

What is an Excise Stamp?

An Excise Stamp is a stamp that a manufacturer or importer of tobacco or vapour products must obtain from the Government of Canada and affix to their product before it is sold in the duty-paid market. For tobacco products, there are excise duty stamps specific to each province that the product will be sold in, in addition to a federal, peach-coloured excise stamp. For vaping products, there is only one excise stamp: the federal, peach-coloured stamp.

Manufacturers and Importers of Tobacco Products

Whether you manufacture or import tobacco products, you will need to register for the excise stamp regime. There is, however, a specific exemption for people who are manufacturing for their own personal use if they meet certain conditions. Excise duty is payable on tobacco products, and the excise stamp affixed to a tobacco product shows to the public and law enforcement that excise duty has been paid in respect of the product. Tobacco manufacturers and importers must keep records of information and file returns with the Government of Canada. An excise stamp must be applied to all manufactured tobacco, which is defined as “every article, other than a cigar or packaged raw leaf tobacco, that is manufactured in whole or in part from raw leaf tobacco by any process.”

Importers of Pre-Packaged Vaping Products

Are you an importer of vaping products that are already packaged before they come into Canada? While you may not need a vaping licence, you will likely need to register for what’s called Vaping Prescribed Persons registration. I talk more about it in the page here. Additionally, you will need to apply for the excise duty stamp regime and apply the stamp before the product is imported into Canada. This means that if you do not. Enforcement of this new regime starts October 1, 2022, so it is very important that before then you have applied for the correct registration and are ready to comply with the requirements of the regulations. Failure to comply with these regulations could result in significant penalties and delays in your product entry. It is advisable to seek vaping legal representation in Canada to ensure that you navigate the compliance landscape effectively. Consulting with experts will help you understand your obligations and avoid potential pitfalls associated with the importation process.

Manufacturers of Vaping Products

Similar to importers of pre-packaged vaping products, if you manufacture vaping products you must register for the excise stamp regime and obtain excise stamps. You will have to apply the excise stamp at the time the vaping product is manufactured — before it enters the duty-paid market. Just like other parties that need to register for the excise stamping regime, you must keep records as well as file information returns with the Canadian government.

Ordering Excise Stamps

The Canadian government has an online stamp ordering system set up through which you must purchase your excise stamps. The stamp purchaser can log into this system and place an order. Note that there are some differences between the tobacco and vaping excise stamp ordering systems, and they have separate login systems. Please note that the excise duty stamps themselves cost money (typically under 1 cent each) and this fee needs to be paid in order to obtain the excise stamp.

For more information on the vaping tax, click here.

Excise Duty Lawyer in Toronto, Ontario

You deserve a dependable and reliable lawyer on your side. Harrison Jordan is a Toronto-based lawyer assisting businesses with their cannabis, tobacco and vaping excise duty stamping and licensing needs. Call him at +1 647 371 0032 or email him today. He’ll get back to you as soon as he can. Harrison brings extensive knowledge of the legal landscape surrounding cannabis regulations and is dedicated to ensuring your business complies with all requirements. He also specializes in obtaining security clearance for cannabis licenses, streamlining the process to help you focus on your operations. Trust Harrison to be your partner in navigating the complexities of this evolving industry. Harrison Jordan is well-versed in navigating the complexities of the tobacco retail dealer permit process, ensuring that you meet all regulatory requirements efficiently. With his expertise, you can focus on growing your business while he handles the legal intricacies. Contact him for personalized assistance tailored to your specific needs.